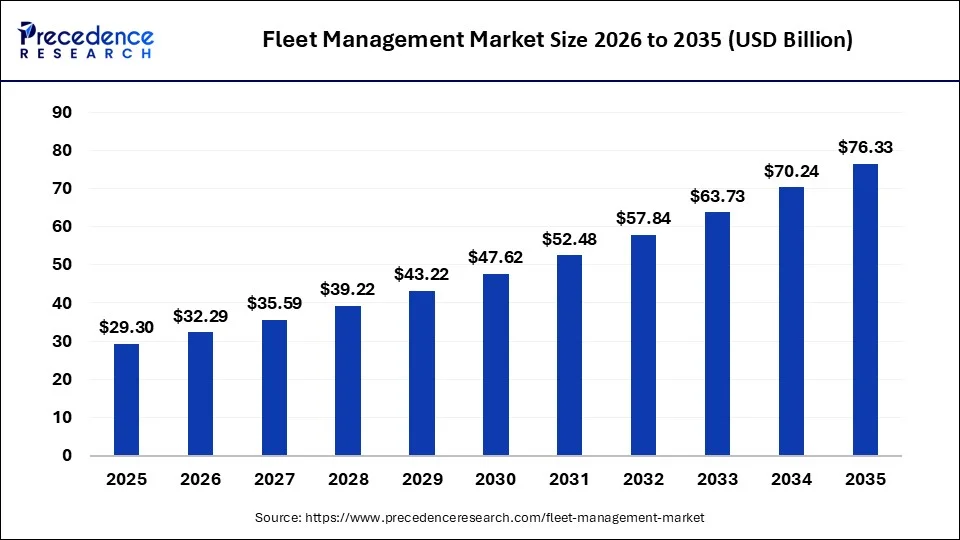

Ottawa, Feb. 19, 2026 (GLOBE NEWSWIRE) -- According to Precedence Research, the global fleet management market size will grow from USD 32.29 billion in 2026 to nearly USD 76.33 billion by 2035, growing at a notable CAGR of 10.05% from 2026 to 2035.

Growth driven by rapid advancements in AI, telematics, and cloud-based platforms. The surge in e-commerce and last-mile delivery is accelerating demand for real-time tracking, route optimization, and predictive maintenance solutions.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/2059

Fleet Management Market Key Takeaways

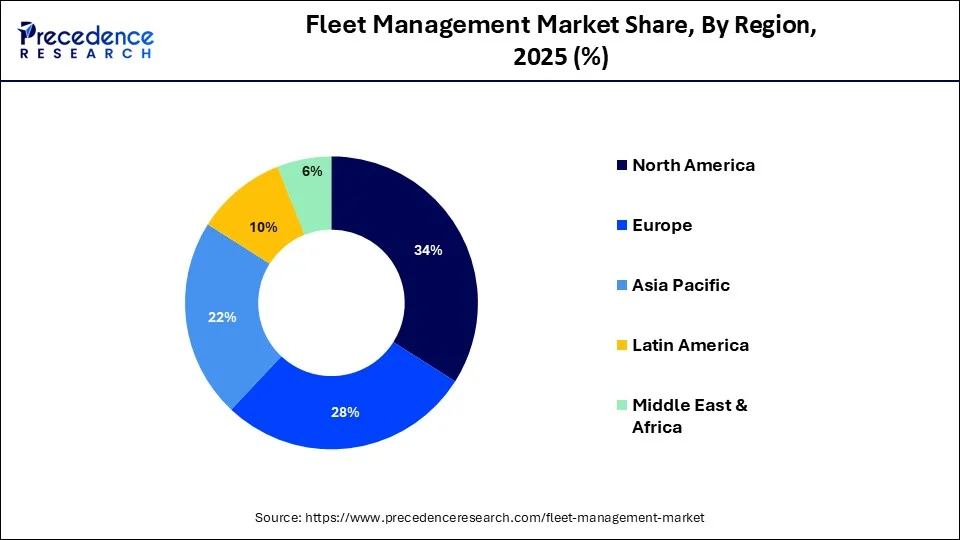

- North America accounted for nearly 34% of the global market share in 2025.

- Asia Pacific is expected to witness the highest regional growth, expanding at a CAGR of 12.3% from 2026 to 2035.

- The commercial vehicle segment dominated the market in 2025, accounting for approximately 73.8% of total revenue.

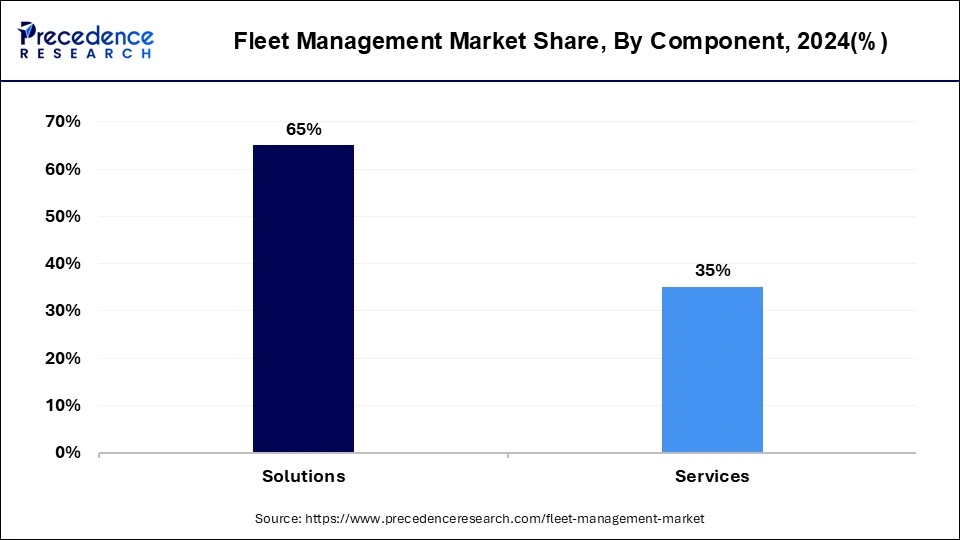

- By component, the solutions segment held the largest share, contributing around 65% of the market revenue in 2025.

- The services segment is projected to grow at the fastest pace, registering a CAGR of 11.0% during the forecast period.

- By deployment model, the on-premises segment led the market with a 54.0% share in 2025.

- The cloud-based (SaaS) segment is anticipated to grow at the highest CAGR of 14.0% over the forecast period.

- Within vehicle types, light commercial vehicles (LCVs) captured a significant 41.5% share in 2025.

- The off-highway and construction equipment segment is expected to grow at the fastest CAGR of 12.3% during the projected period.

- By end-user industry, the transportation and logistics segment dominated with a 32.6% market share in 2025.

- The energy and utilities segment is projected to register the highest growth, with a CAGR of 10.9% over the study period.

What is Fleet Management?

Fleet management is the systematic process of optimizing and overseeing a company’s vehicle fleet. It performs activities like repairing, tracking, and maintaining vehicles. It monitors the behaviour driver and improves the fuel management. Fleet management integrates software technology and increases the productivity of the fleet.

The major components of fleet management are maintenance management, driver management, compliance, vehicle acquisition, fuel management, safety, and vehicle disposal. It offers benefits like lowering downtime, making data-driven decisions, lowering maintenance costs, offering real-time tracking, and optimizing routes.

A fleet is a collective group of aircraft, vehicles, and ships managed by a single organization. The types of fleet are service, public, commercial, transportation, corporate, logistics, specialized, and rental. They include heavy-duty vehicles, non-powered assets, light-duty vehicles, and specialized machinery. The characteristics of a fleet are real-time visibility, performance monitoring, safety, centralized ownership, preventive maintenance, scalability, and compliance. Fleet focuses on key metrics like utilization rate, vehicle attributes, vehicle age, and fuel efficiency.

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Private Industry Investments for Fleet Management

- AI-Powered Safety Platforms: Firms like Netradyne and GoMotive are receiving significant venture funding to develop vision-based AI that monitors driver behavior and prevents accidents in real-time.

- Predictive Maintenance Solutions: Private equity and venture capital are backing startups like Intangles that use Internet of Things (IoT) and digital twin modeling to predict vehicle health issues and reduce operational downtime.

- Unified "Fleet Ops" Ecosystems: Leading providers such as Samsara and Geotab are investing heavily in integrated cloud platforms that consolidate telematics, compliance, and maintenance into a single command center.

- EV Infrastructure and Charging Networks: Large-scale private investments from automakers like VinFast and Suzuki are targeting the development of dedicated EV manufacturing and fleet-specific charging infrastructure.

- Consolidated Global Operations (M&A): Strategic acquisitions, such as Traxall International's buyout of Fleet Logistics Group, represent private moves to create cross-border services that optimize global vehicle utilization.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2059

What are the Key Trends of the Fleet Management?

- AI-Driven Proactive Operations: Fleet management is shifting from reactive reporting to real-time, predictive decision-making where AI identifies high-risk driving patterns or vehicle mechanical failures before they result in accidents or breakdowns.

- Operational Sustainability and Electrification: Companies are increasingly integrating electric and hybrid vehicles into their fleets to meet stricter environmental regulations and reduce long-term fuel costs, supported by sophisticated software for charging and energy management.

Built for leaders who move markets. Access live, actionable intelligence with Precedence Q. https://www.precedenceresearch.com/precedenceq/

Fleet Management Market Opportunity

Growing E-Commerce

The growth of online shopping and the growing route optimization in e-commerce increases demand for fleet management. The increased pressure on logistics firms and the focus on tracking packages require fleet management. The growing rate of last-mile deliveries and the rise in courier activities increases adoption of fleet management.

The strong focus on precise delivery and the need for shipment locations to be updated live increases demand for fleet management. The increased use of EVs in logistics delivery and the robust growth in e-commerce businesses require fleet management. The growing e-commerce creates an opportunity for the growth of fleet management.

Get informed with deep-dive intelligence on AI’s market impact https://www.precedenceresearch.com/ai-precedence

Fleet Management Market Report Coverage

| Report Metrics | Details |

| Market Size in 2025 | USD 29.30 Billion |

| Market Size in 2026 | USD 32.29 Billion |

| Market Size by 2035 | USD 76.33 Billion |

| Growth Rate (2026 - 2035) | 10.05% CAGR |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Vehicle, Component, Communication Technology, Deployment Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

➤ Access the Full Fleet Management Market Study @ https://www.precedenceresearch.com/fleet-management-market

Fleet Management Market Regional Insights

Why North America is Dominating the Fleet Management Market?

North America dominated the market in 2025. The stricter regulations for managing fuel efficiency and the growth in utilization of commercial vehicles increase demand for fleet management. The robust growth in electric vehicles and the transition to cloud-based solutions increases adoption of fleet management. The well-developed logistics industry and the strong focus on integrated telematics solutions require fleet management, driving the overall market growth.

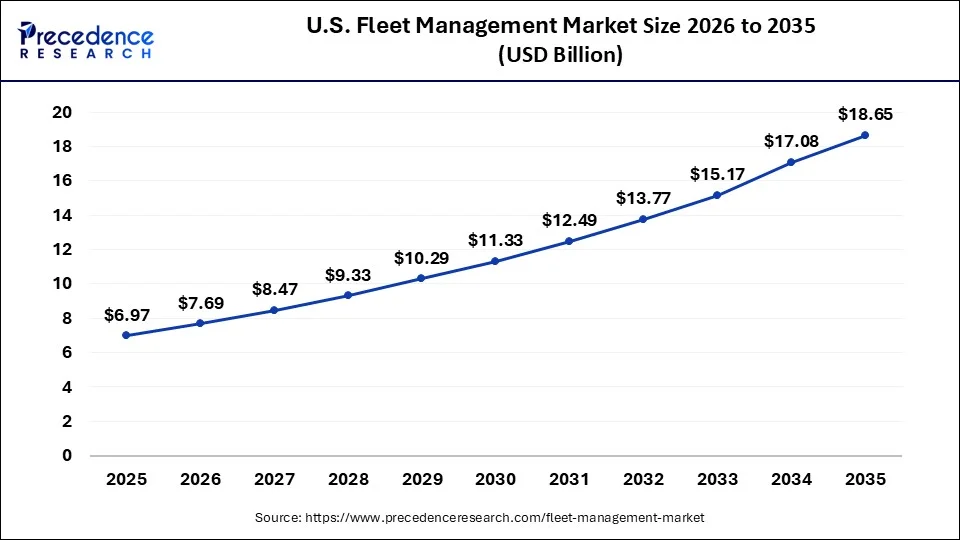

How Big is the U.S. Fleet Management Market Size in 2026?

According to Precedence Research, the U.S. fleet management market size is estimated at USD 7.69 billion in 2026 and is expected to be worth USD 18.65 billion by 2035, accelerating at a CAGR of 10.34% from 2026 to 2035

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/2059

U.S. Fleet Management Market Trends

The U.S. market is experiencing steady growth as companies adopt advanced telematics, real-time vehicle tracking, cloud-based platforms, and AI-driven analytics to improve operational efficiency and enable predictive maintenance. There is a strong shift toward integrating electric vehicle (EV) monitoring and sustainability solutions, driven by federal and state-level emission regulations and corporate ESG commitments.

How is Asia Pacific the fastest-growing Region in the Fleet Management Industry?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The strong focus on enhancing logistic coordination and the stricter safety regulations increases demand for fleet management. The increased investment in connected ecosystems and the growing number of commercial vehicle fleets require fleet management. The robust expansion of e-commerce sectors and the development of smart infrastructure support the overall market growth.

China Fleet Management Market Trends

China’s market is expanding rapidly, driven by the growth of e-commerce, urban logistics, and government-backed smart transportation initiatives in major cities like Beijing and Shanghai. The adoption of AI-powered telematics, IoT-enabled vehicle tracking, and real-time data analytics is accelerating, supported by domestic technology leaders such as Huawei and ZTE.

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

Fleet Management Market Segmental Insights

Component Insights

What made the Solutions Segment Dominate the Fleet Management Market?

The solutions segment dominated the market in 2025. The strong focus on optimizing routes and the need to monitor driver performance increase demand for solutions. The rise in last-mile delivery and the need to enhance vehicle safety require solutions. The operational efficiency, cloud-based accessibility, real-time visibility, and cost-efficiency of solutions drive the market growth.

Deployment Model Insights

How did the On-Premises Segment hold the Largest Share in the Fleet Management Market?

The on-premises segment held the largest revenue share in the fleet management industry in 2025. The strong focus on managing massive fleets and the presence of large-scale fleet operators increase demand for on-premises systems. The customization, data control, reduced long-term costs, privacy controls, no internet dependency, and security of on-premises support the overall market growth.

Vehicle Type Insights

Which Vehicle Type Dominated the Fleet Management Market?

The light commercial vehicles (LCV) segment dominated the market in 2025. The expanding e-commerce services and the focus on short-distance routes increase the adoption of LCVs. The growing congestion in city streets and the stringent regulations for emissions increase the adoption of LCVs. The rapid growth in courier services and the growing expansion of the retail industry increases adoption of LCVs, driving the overall market growth.

Fleet Size Insights

Why the Large Fleets Segment is Dominating the Fleet Management Market?

The large fleets segment dominated the fleet management industry in 2025. The need to lower vehicle downtime and the focus on avoiding hefty penalties increase demand for large fleets. The growing delivery volumes and the stringent ELD mandates increase demand for large fleets. The operational efficiency, safety, efficient data management, and cost reduction in large fleets support the overall market growth.

End-User Industry

Which End-User Industry held the Largest Share in the Fleet Management Market?

The transportation and logistics segment held the largest revenue share in the fleet management industry in 2025. The rise of electric vehicles and the growth in on-time delivery services increase demand for fleet management. The logistics companies focus on managing maintenance, and the increased utilization of heavy vehicles increases the adoption of fleet management. The rising last-mile logistics and the expansion of the transportation industry drive the market growth.

✚ Related Topics You May Find Useful:

➡️ Smart Fleet Management Market: Explore how IoT integration, real-time data analytics, and connected mobility solutions are transforming fleet efficiency and operational visibility worldwide

➡️ AI-Enabled Fleet Management System Market: Discover how artificial intelligence is optimizing route planning, predictive maintenance, and cost control across modern fleet operations

➡️ Vehicle Tracking Systems Market: Analyze the growing adoption of GPS-based monitoring, telematics, and compliance-driven tracking solutions across logistics and transportation sectors

➡️ Transportation System and Analytics Market: Understand how big data, cloud platforms, and intelligent analytics are reshaping traffic management and smart mobility infrastructure

➡️ Advanced Vehicle Diagnostics and Remote Services Market: Gain insights into the rise of connected vehicle diagnostics, over-the-air updates, and remote service capabilities driving next-generation automotive innovation

Fleet Management Market Value Chain Analysis

- Infrastructure Development: The infrastructure development focuses on physical infrastructure, software management systems, digital infrastructure, Electric Vehicle Charging Infrastructure, operational support systems, telematics infrastructure, and maintenance infrastructure.

- Key Players:- Geotab, Motive, ChargePoint, Samsara, Verizon Connect, Fleet Complete

- Warehousing and Inventory Management: The warehousing focuses on aspects like efficient processes, storage, asset monitoring, and layout. Inventory management works on data accuracy, stock control, and automated tracking.

- Key Players:- Mahindra Logistics, Varuna Group, DHL Supply Chain, Fleetio, Fiix Software, ToolSense

- Regulatory Compliance and Customs Clearance: The aspects of regulatory compliance are environmental standards, technology utilization, driver safety, documentation, vehicle safety, and reporting. The customs clearance involves regulatory adherence, documentation, and tax compliance.

- Key Players:- Motive, Fleetworthy, Fleetable, Vamosys, Samsara, Verizon Connect, Logistics Plus, APT Logistics, Descartes

Top Companies in the Fleet Management Market & Their Offerings:

Tier 1:

- Trimble Transportation & Logistics: Provides cloud-based transportation management systems (TMS) and telematics that integrate AI-driven analytics with predictive maintenance.

- Fleetmatics Group PLC: Now part of Verizon Connect, it focuses on GPS tracking, driver behavior monitoring, and automated compliance for small to mid-sized fleets.

- TomTom N.V.U.S: Delivers precision location technology and AI-driven navigation tools optimized for commercial vehicle routing and lane-level accuracy.

- AT&T Inc.: Offers a suite of IoT-connected solutions, including real-time asset tracking and AI-powered video telematics, leveraging its nationwide cellular network.

- I.D. Systems: Operating as Powerfleet, it provides an AI platform for managing diverse assets, ranging from on-road trucks to industrial warehouse equipment.

- General Services Administration (GSA): Manages a massive shared-service leasing and purchasing program specifically for federal agencies and authorized tribal organizations.

- Telogis: Now integrated into Verizon Connect, it specializes in enterprise-level work order management and sophisticated route optimization software.

- Freeway Fleet Systems: Focuses on specialized workshop and maintenance management software, digitizing defect reporting and spare parts inventory.

Tier 2:

- IBM Corporation

- Navico

- Grupo Autofin de Monterrey

- Grab

- Scope Technologies

- Troncalnet

- FAMSA

- Ola Cabs

- MiTAC International Corporation

- Cisco Systems

- Uber Technologies

- Didi Chuxing

- DC Velocity

- European GNSS Agency (GSA)

Recent Developments

- In April 2025, Solera launched a new fleet management platform, Solera Fleet Platform, for commercial operations. The platform enhances driver safety, streamlines compliance processes, maximizes asset utilization, predicts vehicle downtime, improves the efficiency of routes, and enhances vehicle safety.

(Source:-https://www.fleetowner.com)

- In February 2026, ACMobility launched an electric vehicle fleet management platform, ChargeFleet. The platform offers features like scalability, centralized control, and instant deployment. (Source:-https://www.abs-cbn.com)

- In October 2025, Aion-Tech Solutions launched the ROQIT platform for zero-emission fleet management. The platform is designed for buses, railway assets, four-wheelers, and trucks. The platform provides features like predictive maintenance, emissions monitoring, driver performance analytics, live asset tracking, regulatory compliance, integration with IoT platforms, and AI-assisted route optimization. (Source:-https://auto.economictimes.indiatimes.com)

Segments Covered in the Report

By Component

- Solutions (Software):

- Operations Management:

- Asset/Vehicle Tracking & Geo-fencing

- Routing & Scheduling Optimization (e.g., Multi-stop, Dynamic Routing, Last-mile Delivery Optimization)

- Dispatch Management (e.g., Job Assignment, Real-time Communication)

- Vehicle Maintenance & Diagnostics:

- Predictive Maintenance (AI/ML-driven)

- Preventive Maintenance Scheduling

- Fault Code Diagnostics & Alerting

- Tire Pressure Monitoring System (TPMS) Integration

- Fluid Level Monitoring (e.g., fuel, oil, DEF)

- Performance Management:

- Driver Management & Safety:

- Driver Behavior Monitoring (e.g., speeding, harsh braking, idling, distracted driving, fatigue detection)

- Driver Coaching & Gamification

- Electronic Logging Devices (ELD) Compliance

- Driver ID & Access Control

- Accident Reconstruction & Reporting

- Fuel Management:

- Fuel Consumption Monitoring & Reporting

- Fuel Card Integration & Transaction Tracking

- Fuel Efficiency Analysis & Optimization

- Idle Time Management

- Driver Management & Safety:

- Fleet Analytics & Reporting:

- Business Intelligence Dashboards

- Custom Report Generation

- Key Performance Indicator (KPI) Tracking

- Data Visualization

- Benchmarking

- Compliance & Risk Management:

- Hours of Service (HOS) Compliance

- Driver Vehicle Inspection Report (DVIR) Management

- Emissions Monitoring & Reporting

- Regulatory Compliance (e.g., FMCSA, ELD Mandates)

- Insurance & Claims Management

- Other Solutions:

- Payment Management

- Inventory Management (for parts, etc.)

- Vehicle Acquisition & Disposal Management

- Leasing & Rental Management

- Mobile Applications for Drivers & Managers

- Operations Management:

- Services:

- Professional Services:

- Consulting & Strategy Development

- Implementation & Integration (with ERP, CRM, TMS, etc.)

- Data Migration

- Customization

- Training & Onboarding

- Professional Services:

- Managed Services:

- Full-Service Fleet Management Outsourcing

- Data Monitoring & Analysis

- Technical Support & Helpdesk

- Hardware as a Service (HaaS)

- Support & Maintenance:

- Technical Support (24/7, multi-channel)

- Software Updates & Upgrades

- Troubleshooting & Bug Fixing

- Hardware:

- Telematics Devices:

- GPS Tracking Devices (Real-time, Passive)

- OBD-II Dongles

- J1939 Connectors (for heavy-duty vehicles)

- Embedded Telematics Systems (OEM-installed)

- Aftermarket Devices

- Safety & Monitoring Hardware:

- Dash Cameras (Single-lens, Multi-lens, AI-powered)

- Driver-facing Cameras

- Road-facing Cameras

- Advanced Driver-Assistance Systems (ADAS) Integrations (e.g., Lane Departure Warning, Forward Collision Warning)

- Blind Spot Monitoring Systems

- Sensors:

- Fuel Level Sensors

- Temperature Sensors (for reefer trucks)

- Tire Pressure Sensors

- Cargo Sensors

- Door Open/Close Sensors

- Connectivity Modules:

- Cellular Modems (4G LTE, 5G)

- Satellite Communication Devices

- Bluetooth Modules

- Wi-Fi Modules

- Other Hardware:

- Data Loggers

- RFID Readers

- Vehicle Gateways

- Telematics Devices:

By Deployment Model

- Cloud-based (SaaS):

- Public Cloud

- Private Cloud

- On-Premises

- Hybrid

By Vehicle Type

- Light Commercial Vehicles (LCVs):

- Vans

- Pickup Trucks

- Small Delivery Trucks

- Heavy Commercial Vehicles (HCVs):

- Heavy-duty Trucks (Class 8)

- Semi-trailers

- Dump Trucks

- Tankers

- Buses and Coaches:

- School Buses

- Public Transit Buses

- Tour Buses

- Trailers/Semi-Trailers:

- Dry Van Trailers

- Refrigerated Trailers (Reefers)

- Flatbed Trailers

- Specialized Trailers

- Off-highway & Construction Equipment:

- Excavators

- Bulldozers

- Loaders

- Cranes

- Agricultural Machinery (Tractors, Harvesters)

- Mining Vehicles

- Passenger Cars:

- Corporate Fleets

- Rental Cars

- Ride-sharing Vehicles

- Other Specialized Vehicles:

- Emergency Vehicles (Ambulances, Fire Trucks)

- Waste Management Vehicles

- Utility Vehicles

- Forklifts & Warehouse Equipment

By Fleet Size

- Small Fleets: (e.g., 1-49 vehicles)

- Mid-sized Fleets: (e.g., 50-199 vehicles)

- Large Fleets: (e.g., 200-999 vehicles)

- Enterprise Fleets: (e.g., 1000+ vehicles)

By End-User Industry

- Transportation & Logistics:

- Freight & Shipping

- Courier & Express Delivery

- Third-Party Logistics (3PL)

- Public Transportation

- Construction & Mining:

- Heavy Civil Construction

- Building Construction

- Underground Mining

- Surface Mining

- Energy & Utilities:

- Oil & Gas (Upstream, Midstream, Downstream)

- Electric Utilities

- Water & Wastewater Utilities

- Telecommunications Utilities

- Manufacturing & Retail Distribution:

- Consumer Goods Distribution

- Automotive Manufacturing

- Industrial Manufacturing

- Wholesale & Retail Logistics

- Government & Public Safety:

- Municipal Fleets

- Police Departments

- Fire Departments

- Emergency Medical Services (EMS)

- Military Fleets

- Field Service Management:

- HVAC Services

- Plumbing Services

- Pest Control Services

- Landscaping Services

- Home Healthcare Services

- Food & Beverage:

- Food Distribution (Perishable, Non-perishable)

- Beverage Distribution

- Catering Services

- Rental & Leasing:

- Vehicle Rental Companies

- Equipment Rental Companies

- Fleet Leasing Providers

- Waste Management:

- Solid Waste Collection

- Recycling Services

- Hazardous Waste Management

- Healthcare & Pharmaceuticals:

- Medical Device Delivery

- Pharmaceutical Distribution

- Mobile Clinics

- Agriculture:

- Farm Equipment Fleets

- Produce Transportation

- Others:

- Education (School Bus Fleets)

- Hospitality (Hotel Shuttle Services)

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2059

You can place an order or ask any questions. Please feel free to contact us at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Chem and Materials | Towards FnB | Statifacts | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter