CANTON, Ohio, Feb. 11, 2026 (GLOBE NEWSWIRE) -- Real estate brokerage leaders enter 2026 with steady confidence in business growth, housing demand, and the U.S. economy, according to the newest Delta Media Real Estate Leadership Survey of more than 100 brokerage leaders representing firms collectively responsible for more than two thirds of all U.S. home sales last year.

Now in its fourth consecutive year, the Delta Media Real Estate Leadership Survey reveals how brokerage leaders view the economy and the housing market after several years of disruption. Conducted by Delta Media Group, a leading technology partner to more than 80 LeadingRE Affiliates and over 50 top ranked brokerages nationwide, the 2026 survey reflects views shaped by cost pressure, changing consumer behavior, and closer scrutiny of execution.

This year’s results show optimism holding firm, even as leaders remain direct about margin pressure, inventory constraints, and operational discipline.

From defensive to deliberate

The 2026 findings mark a clear shift from the uncertainty that defined earlier surveys.

In 2023, a majority of brokerage leaders expected both the U.S. and global economies to deteriorate. Profitability expectations were low, and many firms focused on cost control. By 2024, confidence began to stabilize as local housing conditions improved. In 2025, optimism reached a three year high across profitability, transaction volume, and market share expectations.

“The 2026 outlook shows confidence has not faded. It has hardened,” said Michael Minard, CEO and Owner of Delta Media. “Brokerage leaders now expect growth while staying focused on pricing pressure, margins, and execution,” he explained.

Economic confidence stays close to home

Most brokerage leaders expect the U.S. economy to improve over the next 12 months (59%). Fewer predict deterioration (20%), one in five expect it to stay the same, and a small share expect a sharp decline (1%). Economic confidence remains strongest at the local level, followed by state then national economies.

“This pattern has remained consistent since we started this real estate leadership survey in 2023,” Minard said. “What changed in 2026 is balance. Leaders report fewer extremes and more stable expectations across every economic level.”

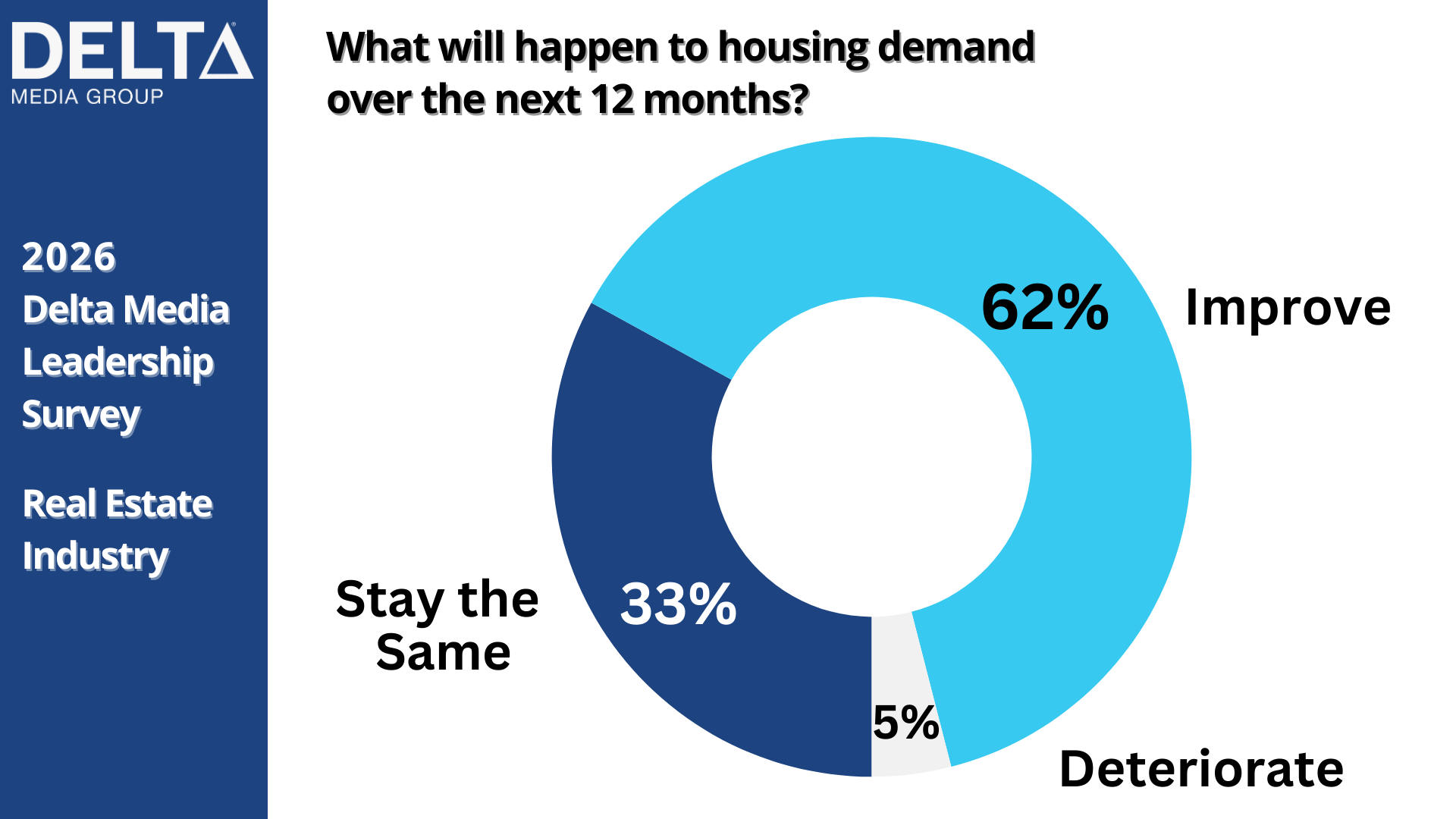

Housing demand remains a bright spot

Housing demand continues to support brokerage confidence.

Nearly two thirds of brokerage leaders (62%) expect housing demand to improve in 2026. A smaller share expects demand to remain steady (33%), and few anticipate a decline (5%). This marks a clear change from 2023, when expectations were evenly split between improvement, stability, and decline.

Affordability, inventory levels, and mortgage rates continue to limit activity in many markets. Even so, demand expectations remain one of the most consistent positives in the survey.

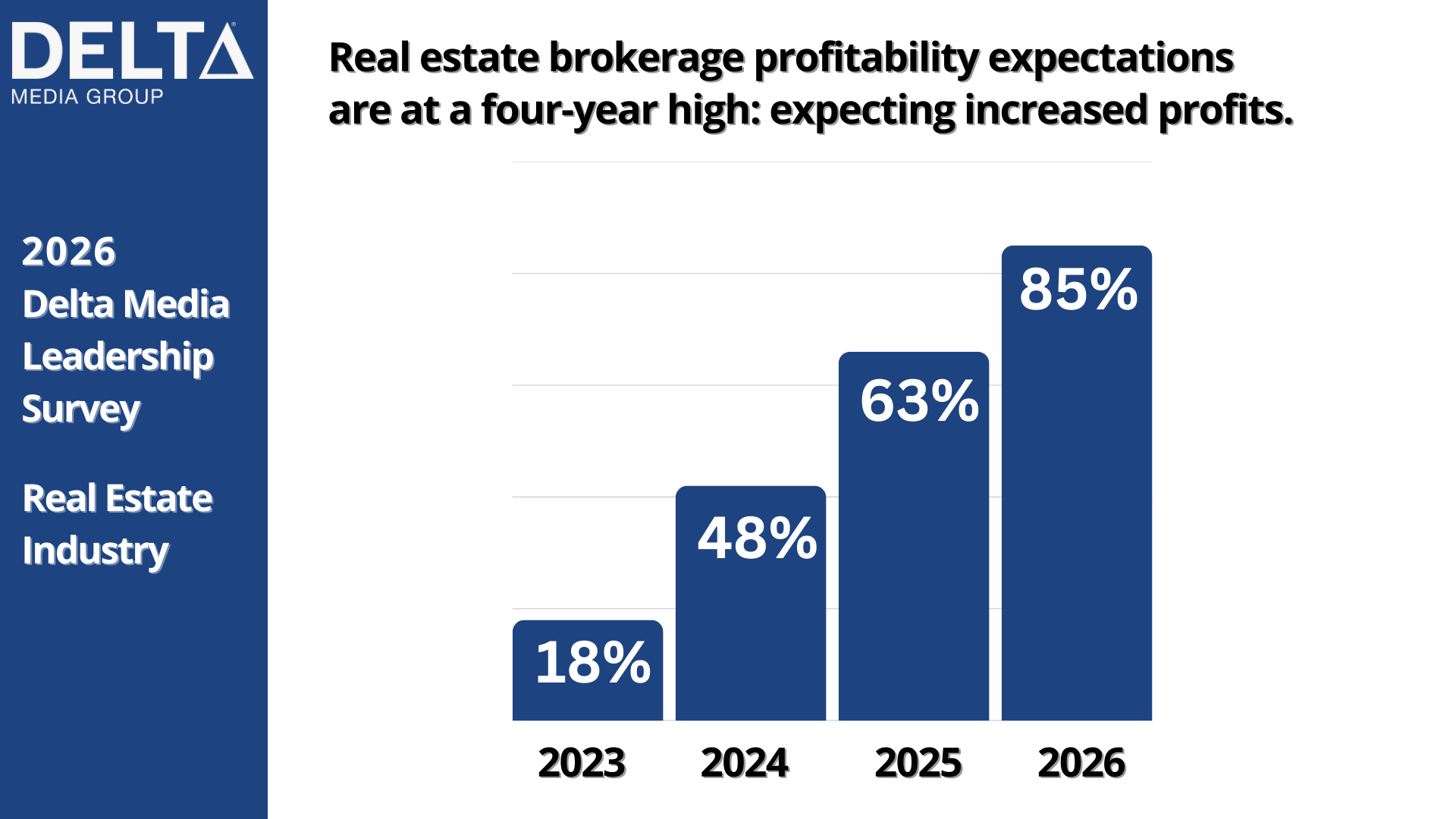

Profitability and transactions point upward

Confidence in core business performance remains strong.

More than eight in ten brokerage leaders expect profitability to increase in 2026 (85%). A similar share expects transaction sides to rise (82%). Two thirds believe their firm will gain market share over the next year (66%).

“These results stand in sharp contrast to 2023, when more than half of leaders expected profitability to decline,” Minard said. “The shift reflects years of adjustment in staffing, expenses, and technology decisions.”

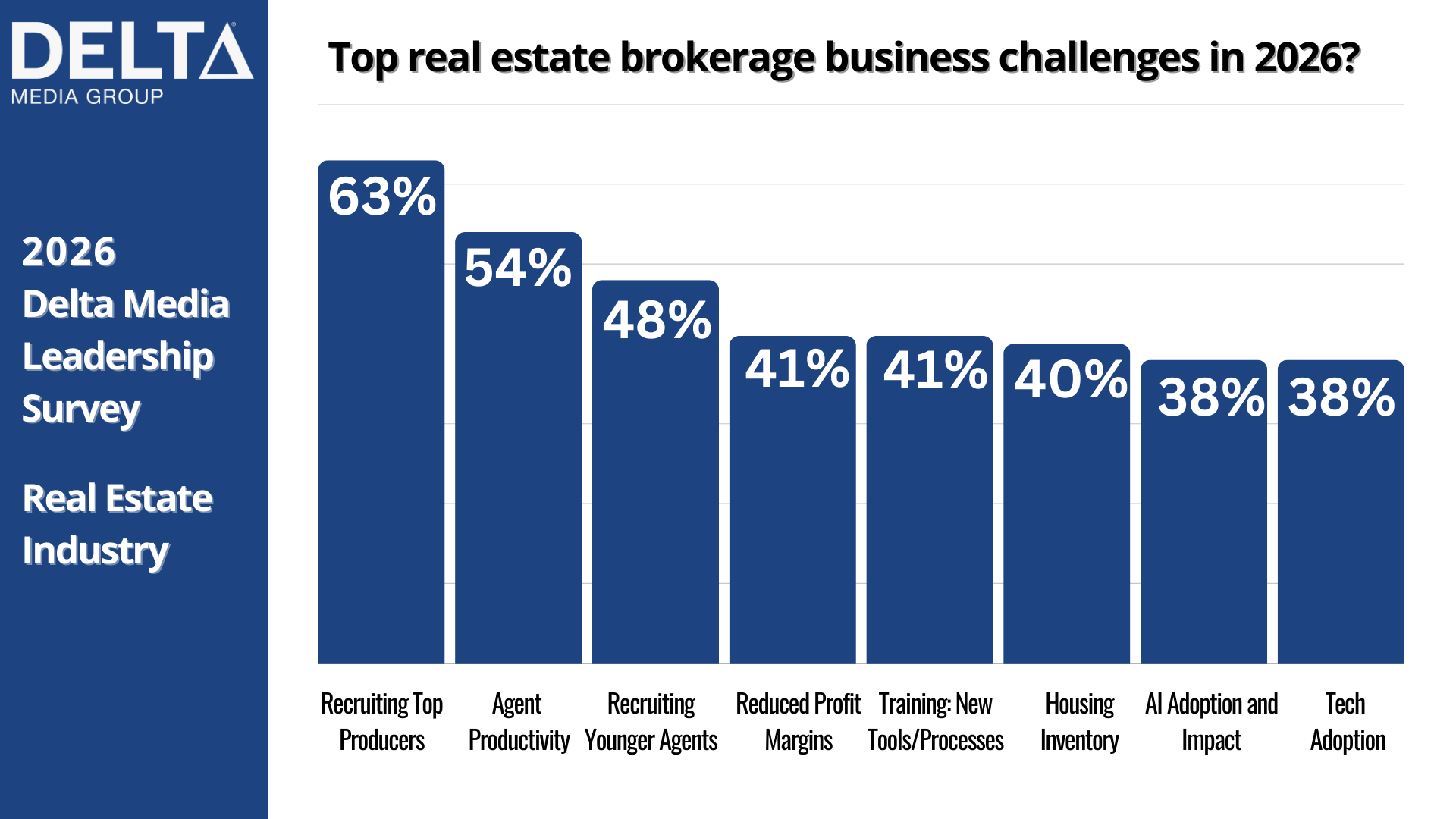

The pressure beneath the optimism

Optimism does not remove pressure.

When asked about their top business challenges in 2026, leaders most often cite agent recruiting top producers (63%), agent productivity (54%), recruiting younger agents (48%), reduced profit margins and training agents on new tools/processes (both 41%). Housing inventory (40%) and AI adoption and impact (38%) remain persistent concerns.

Technology adoption (38%) also continues to test brokerages. Leaders point to agent usage, training, and return on investment as ongoing hurdles, especially as AI tools move from experimentation to daily operations.

The message remains consistent. Growth exists, but execution decides who captures it.

A shift in how leaders view AI

“AI is no longer a future concept,” said Minard. “We know from the release of our AI Survey that 97% of brokerage leaders say their agents are using AI. AI use in real estate is ubiquitous. The focus has shifted to structure and strategy.”

The 2026 data shows that brokerage leaders focus on practical outcomes. They want tools that fit existing workflows, respect agent preferences, and produce measurable business results. Adoption and accountability now matter more than novelty.

This shift mirrors broader operational changes across brokerages, where technology decisions tie directly to productivity, margins, and agent retention.

Clear expectations for the year ahead

The 2026 Delta Media Real Estate Leadership Survey shows an industry that has regained its footing without losing caution. Brokerage leaders expect growth yet remain direct about the forces that could slow it.

“After four years of tracking brokerage sentiment, what stands out this year is clarity,” added Minard. “Leaders are no longer guessing about the market. They know where growth can come from, and they know what threatens it.”

About the Survey

Over 100 real estate broker owners and top-level brokerage executives responded to the Delta Media Real Estate Leadership Survey in December 2025.

Demographics show that 62% of respondents were male, 34% were female, and 4% chose not to answer. Almost 40 percent were at least 60 years old, 39% were ages 50 to 59, 14% were ages 40 to 49, and 8% were 39 or younger.

By brokerage size, 20% manage firms with more than 1,000 agents, 7% manage 501 to 1,000 agents, 38% manage 101 to 500 agents, 20% manage 21 to 100 agents, and 15% manage 20 or fewer agents.

Transaction volume varied widely. Transaction volume varied widely. Brokerages with more than $5 billion in annual transactions represented 17% of respondents. Firms with $1 to $5 billion accounted for 17%, $501 million to $1 billion represented 16%, $101 million to $500 million accounted for 24%, $51 million to $100 million represented 10%, and firms with less than $50 million accounted for 16%.

About Delta Media Group

Delta Media Group, Inc. is America’s largest family-owned real estate technology provider for brokerages. Located in Canton, Ohio, it is the inventor of DeltaNET, known as the industry’s most advanced CRM-based, all-in-one digital marketing platform. One of the largest real estate technology solutions firms in the US, Delta Media is the trusted technology partner for more than 80 LeadingRE Affiliates and over 50 top-ranked brokerages nationwide. Discover more at deltamediagroup.com.

Media contacts:

Kevin Hawkins (206) 866-1220

kevin@wavgroup.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/9e3106de-a212-4aa1-8e5b-586347d3b043

https://www.globenewswire.com/NewsRoom/AttachmentNg/18a13625-9fea-4460-9196-d38de6260bd2

https://www.globenewswire.com/NewsRoom/AttachmentNg/5ec6dedf-5814-46e2-b8d3-76942ba51d81

https://www.globenewswire.com/NewsRoom/AttachmentNg/811b0f54-0ca7-46a6-943f-c133858d35ed

https://www.globenewswire.com/NewsRoom/AttachmentNg/05fd2a89-2c17-40b6-9df0-5cd72a621189